We all know it: the generic pharma industry is extremely competitive.

From development to commercialization, one principle drives everything: delivering high-quality, affordable medicines while ensuring profitability to fund future developments.

One of the most critical steps in this process is selecting the right active pharmaceutical ingredient (API) suppliers.

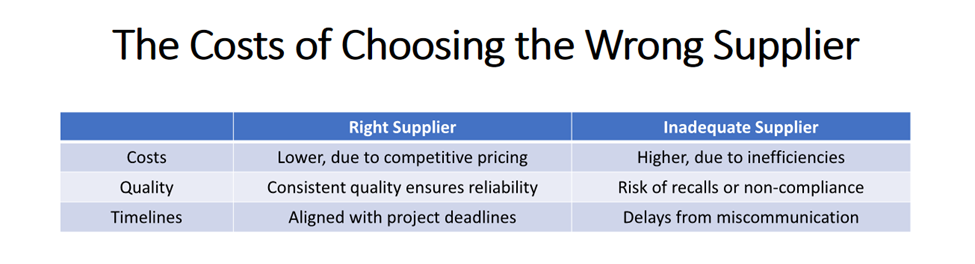

Why? The right supplier doesn’t just provide technical support for timely development — it also secures long-term competitiveness. On the other hand, choosing an inadequate supplier can negatively impact the entire lifecycle of your product. That’s why a structured and diligent supplier evaluation process is essential.

Our Approach to API Supplier Selection, Proven Over Decades

Sourcing the right supplier goes beyond finding GMP-certified manufacturers and comparing price quotes. It’s about identifying partners who align with your short- and long-term needs. When done right, this process saves money, reduces risks, and minimizes future complications.

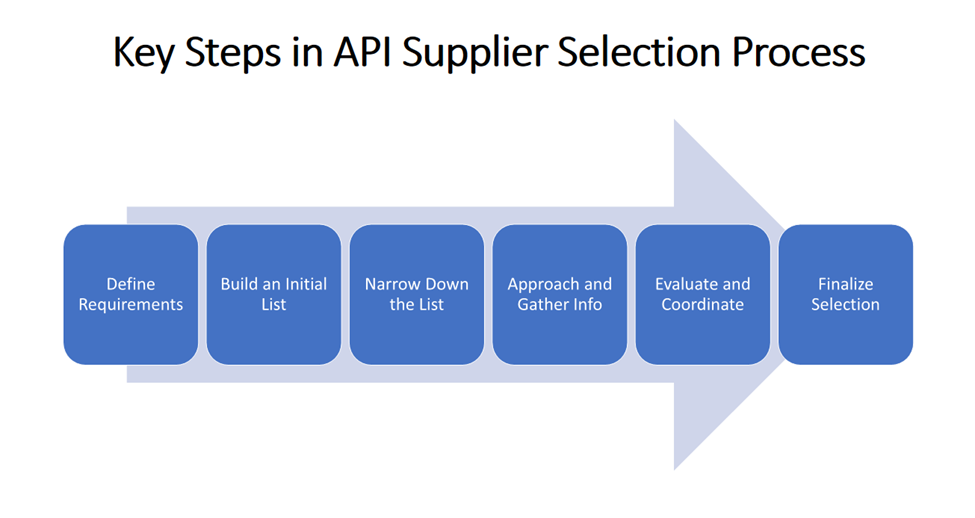

Here’s a step-by-step guide to how we tackle API supplier selection for our customers:

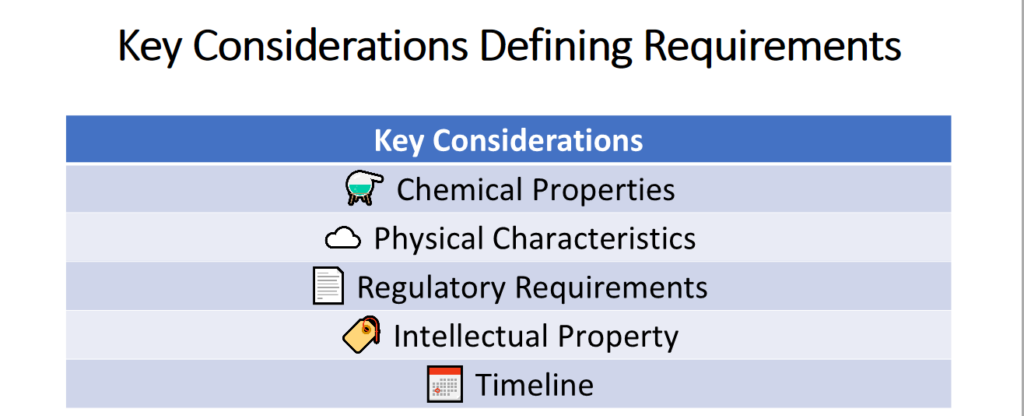

Step 1: Define What You Need

Before starting, it’s crucial to clearly define your requirements. This ensures no time is wasted on unsuitable options. Key considerations include:

• Chemical Properties: Salt form, assay, impurities, residual solvents, etc. — whatever attributes matter for your formulation.

• Physical Characteristics: Particle size, polymorphism, flowability, etc. — critical for product performance.

• Regulatory Needs: Target markets and applicable pharmacopeial requirements.

• Intellectual Property: Patents or exclusivities that could impact your plans.

• Timelines: When do you need samples? What about API for trials, validation, and commercial manufacturing?

Time spent during this step saves weeks (or months) later.

Step 2: Build a List of Potential Suppliers

Once requirements are clear, the next step is to identify manufacturers who might offer the API you need:

• Supplier Databases: A good starting point, though often outdated.

• Web Searches: Time-consuming but sometimes revealing, especially if using AI tools to streamline the process.

• Industry Contacts: Local market intelligence is invaluable. People on the ground in key API manufacturing regions know who’s developing what and can share insights unavailable elsewhere.

This step concludes with a preliminary list of manufacturers to explore further.

Step 3: Narrow Down the List

With an initial list in hand, it’s time to refine it. Here’s what we watch for:

• Regulatory or Quality Issues: Audit failures, recalls, or ongoing regulatory sanctions.

• Slow Responsiveness: Manufacturers who have shown delays in communication or timelines during past interactions.

• Logistical Risks: Manufacturers located in politically unstable regions or areas prone to natural disasters.

• Supply Chain Transparency: Are their suppliers of key starting materials and intermediates also GMP-compliant? Are there geopolitical or natural hazards risks that could impact the supply chain?

• Conflicts of Interest: Manufacturers entering the formulation race, particularly in the same product categories. (Not an automatic disqualifier, but something worth keeping in mind.)

By the end of this step, the list of potential suppliers becomes more focused and manageable.

Step 4: Start Conversations and Gather Information

Now, it’s time to reach out to the shortlisted manufacturers and gather key details:

• Technical Data: Specifications, CoAs, PSD histograms, IP assessments, etc.

• Regulatory Documents: DMFs/Technical Packages, and GMP certificates.

• Pricing: Quotes for development and commercial quantities, with tiered pricing for scaling later on.

• Timelines: Possible delivery schedules for samples, development, and validation quantities.

This step often involves follow-ups — most suppliers don’t provide everything on the first request.

Step 5: Evaluate and Coordinate with the Customer

Once the data is in, it’s time to dig deeper:

• Refine the List Further: Disqualify suppliers that don’t meet the technical, timeline, or regulatory requirements.

• Request Clarifications: Investigate unusually high or low prices.

• Coordinate with Customers: Share data for detailed evaluation and arrange samples to be delivered for full testing. Coordinate remote GMP audits.

• Further Market Intelligence: Dig deeper into the manufacturer’s technical capabilities, capacity, reliability, and reputation. Do they have a robust business continuity plan, and how effectively can they respond to unforeseen challenges?

At the end of this important step, only 4–6 strong candidates should remain on the list.

Step 6: Finalize Selection

With the top-ranking suppliers identified:

• Conduct on-site GMP audits for quality and compliance confirmation.

• Negotiate final pricing and terms.

• Select two final suppliers (three for critical products) to ensure the flexibility to adapt to unexpected supply challenges.

• Sign term sheets.

Why This Process Is Worth It

Smaller companies often have limited resources to thoroughly evaluate API suppliers. But taking the time to do it properly brings undeniable benefits:

• Cost Savings: Better pricing means a stronger bottom line.

• Reduced Risks: Proper selection minimizes risks related to quality, compliance, and supply chain disruptions

• Stronger Partnerships: Reliable suppliers become trusted, long-term partners.

Need Help Sourcing an API?

If this sounds complex, that’s because it is. But you don’t have to do it alone. With decades of experience in API sourcing and a deep understanding of the market, we can help make the process efficient and effective.